Gold IRA Company

1 But some dealers will boost their profits an article by charging hidden one time or monthly fees. In addition, storage fees start at $150 for segregated precious metals storage and $100 for the non segregated alternative. Clients can ship their gold and silver to the depository they choose after opening their gold and silver IRA. Noble Gold offers some of the most fantastic physical gold prices on the market, in addition to quick and secure shipping. The IRS requires that gold IRA metals meet a certain purity threshold and be in an investment grade form. Box 07520 Fort Myers, FL 33919 239.

Software and Business

Gold IRAs are a great way to diversify and protect your retirement savings. Golf carts are best for vivacious and confident individuals. You can use certain reputable and independent business review bodies such as Better Business Bureau BBB to see the ratings of any company of interest. The number of years in business is relevant as well when assessing a gold IRA company, as the veterans in the industry have reached that status by providing top notch services throughout their journey. A bank failure occurs when a financial institution. It has gained recognition for providing award winning services to its clients, and continues to do so to this day. It tends hold its value. Unlike traditional IRAs, which limit investments to stocks, bonds, and mutual funds, a silver IRA allows individuals to diversify their portfolios by including precious metals. They also won’t charge for shipping your physical precious metals and do not charge for insurance and tracking. The former implies that you will have to pay such taxes later, and the latter means you do not have to pay taxes on your earnings, making them tax free. It’s cheaper than gold and it has more industrial uses. Many investors choose to store their gold at home, in a bank safe deposit box, or even buried in their backyard. We remit settlement via bank wire to your custodian within 24 business hours of receiving your precious metals.

What is a Precious Metals IRA?

Please consult legal or tax professionals for specific information regarding your individual situation. Transparent product pricing is important for ensuring you get the best deal. Aside from US IRA approved precious metals, the company also sells Canadian mint coins and bars. The assets you buy will be stored in an IRA approved vault. If you’re age 72 73 starting in 2023 or over and have a Traditional, Rollover, SEP, or SIMPLE IRA, you’re required by law to take the Required Minimum Distributions RMDs annually. Please note that Advantage Gold and its representatives are not licensed or registered investment advisers, attorneys, CPA’s or other financial service professionals. They may not be used by anyone other than a duly licenced member firm of the Network. Titan is an investment platform with a team of experts actively managing your portfolio based on your chosen strategy, including cryptocurrencies. With a team of experienced advisors, Noble Gold offers secure and reliable services to customers. For more information, visit and follow us on LinkedIn and Twitter.

Choose Your Portal

After Equity receives funding, either directly from you or via transfer of an existing IRA, your Rosland Capital representative will contact you to discuss the purchase of precious metals for your IRA account. Let’s talk about how a self directed IRA can help make that happen. Apply for Silvr financing today. If you’re a first time investor, you may change your mind or opt for different products. If you let a company’s sales team make that decision for you, you’ll end up investing 100% of your savings in precious metals. The best gold IRA companies will also have a secure online platform to manage your investments and track the performance of your gold IRA. Monetary Gold provides workshops and individual consultations, so clients understand markets and investment options. Gold, silver, and other investment pieces must be of a certain “fineness” to qualify as an admissible asset in retirement plans. Here’s a traditional vs. Get FREE access to the webinar here. The company is famous for its competitive flat fees. IRA owners are responsible for taking the correct amount of RMDs on time every year, or they will face stiff penalties for failure to do so.

8 Advantage Gold: Best for Silver IRA Rollovers

You may not be surprised to learn that, when it comes to your standard retirement plans, you actually have very little to no involvement or control. Best Gold IRA Companies. Investing in gold can provide a hedge against inflation and economic downturns. Augusta Precious Metals offers an extensive selection of silver products and services, making them a great choice for those looking to diversify their retirement portfolio. In addition, they have tons of video testimonials as well as written reviews from their clients on their website to show that they offer quality service. BA and Honors in Public Diplomacy and Affairs, The Raphael Recanati International School Reichman University DPIJI, Daniel Pearl International Journalism Institute HarvardX. Q: What types of silver can be held in a silver IRA account. But while the asset is within your IRA you can buy and sell as the market for gold and silver changes and take advantage of the gains or losses. We are proud to offer this 2023 silver First Moon Landing coin. However, it’s important to remember that the amount of silver you can purchase is limited by the amount of funds in your account. IRAs are only sometimes easy to understand. Fair pricing for all purchases. Their commitment to quality and customer service make them an excellent choice for IRA silver services.

Gold and Silver IRA

Money Reserve and worry less about tomorrow, today. With Patriot Gold Club, customers can be sure that their investments are in safe hands. IRA Holders have been allowed to use funds in their IRA account to purchase approved precious metals since 1998 after the passage of the Taxpayer Relief Act of 1997. It can also invest in certain platinum coins and certain gold, silver, palladium and platinum bullion. The company offers free shipping on orders over $500. One of the reasons we placed Orion at the top of our list is that they made it easy for us to access educational resources quickly and request a free investor kit to learn more about buying gold and silver through them. Most traditional custodians are structured to only hold paper assets and structured as managed funds. If you are going to make a large initial deposit, then some companies might waive off the setup fees. You may purchase gold bars, coins, or other precious metals.

ADDRESS

After your contributions match the employer sponsored plan figures, an IRA could be the next bet to saving for retirement. The company’s IRA silver services offer investors a secure and reliable way to diversify their portfolios with silver, making it an ideal choice for those looking to invest in the precious metal. Gold and silver backed IRAs are a great way to protect your retirement savings from market volatility and inflation. Simply contact your gold company of choice and complete an Investment Direction. They are known to respond quickly to almost every inquiry and address complaints a complainant raises. Which Metals Are Best for My IRA. Rolling over an employer sponsored retirement account, like a 401k, may be the right choice for you if any of the following are true. Their comprehensive services include retirement planning, asset protection, and a variety of IRA options. When researching gold IRA companies, reviews can help you find the best gold IRA companies. Augusta Precious Metals. IRA rules and regulations limit the amount you’re able to contribute to your account each year. HCF Silver Plus, $241 per month. You’ll easily get a feel for who makes you feel comfortable.

Learn About Depositories, Storage, and Pricing

Investing in gold can provide several benefits and applying for a loan is one way to use gold as collateral to access funds. You will need to have an eligible IRA and transfer over your savings to your new silver or gold IRA. Discover the Benefits of Investing with American Hartford Gold Group Today. By weighing the strengths of each of these twelve brands, investors can make an informed decision about the best company for their needs. A+ Accreditation by the BBB. Whereas regular IRA’s focus on stocks and other paper assets.

GoldCo: Summary Gold IRA

If you are interested in furthering your education on precious metal investing, The Lear Capital Learning Center provides soon to be investors with the comprehensive knowledge needed to begin precious metal investing. They have an A+ rating from the Better Business Bureau, A 4. Your investment is safely stored and managed by a custodian, providing you with expert level protection and financial gain. Gold IRA custodians can also help investors understand the tax implications of investing in gold and provide assistance with filing the necessary paperwork. Your investment is safely stored and managed by a custodian, providing you with expert level protection and financial gain. An investor can hold gold bullion, gold coins and bars as long as they meet two basic standards. BCA: AAA From 1 Review. Some companies, like Birch Gold and Augusta Precious Metals, are known for their excellent customer service and reputation. What sets Augusta apart from the competition is their commitment to education and transparency. They are effective tools for safeguarding money to fund your retirement.

Blog and Articles

Fill out the form: Fill out Patriot Gold Group’s quick online form, and a representative will contact you shortly to initiate your application. Forge Trust has new Banking Information that can be found on our Delivery Information Page. Maximize Your Portfolio with Noble Gold. A third party custodian would serve as the recordkeeper of your precious metals IRA. They offer a wide range of precious metals, including gold, silver, and platinum, and provide expert advice on portfolio diversification. A pleasure doing business with them, I didn’t expect that. To order or inquire, please call 1 800 526 7765 or email. With unallocated or unsegregated storage, the metals are comingled in a depository metal account. Gold coins and bars are required to be at a minimum 99. Some of this is due to the specialized nature of a gold IRA, which requires working with custodians that focus on gold and other physical assets. We trust this article has given you a better understanding of the best silver IRA options.

Silver IRA Products

That’s because a weakening dollar encourages speculative buying of silver. To get started with ETC, you can create an account directly on their website below and begin the onboarding process. It also doesn’t have physical locations, so if you want to walk into a branch to speak with someone in person, you’re better off using a different lender. Oxford Gold Group specializes in helping people diversify their investment portfolio by buying silver, gold, and other precious metals using their current IRAs and 401ks. Both depositories are IRS approved and carry “all risk” insurance policies from Lloyds of London. May 31, 2023 Press Release. It is important to choose a custodian who is reliable and reputable. Augusta Precious Metals is a California based company that offers gold IRAs and a variety of precious metals, coins, and bullion. And learn how to successfully navigate the unregulated gold IRA industry.

Looking for a Precious Metals Advisor You Can Trust? We Can Help With That

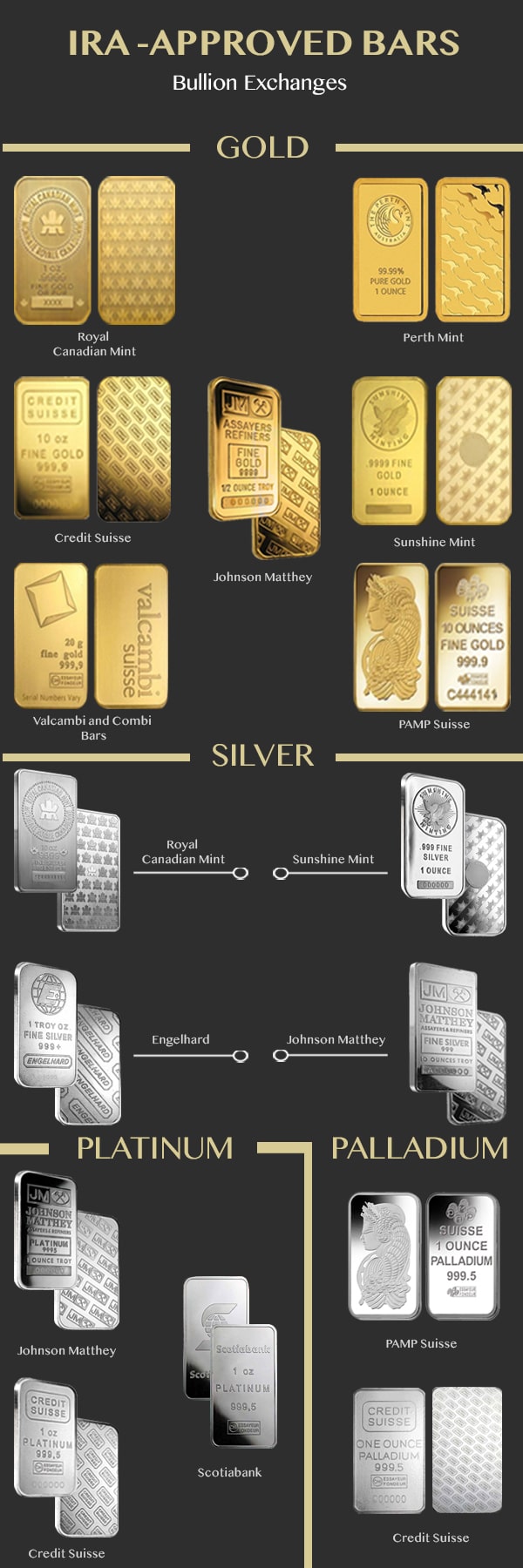

Bars other than 400 ounce gold, 100 ounce gold, 1000 ounce silver, 50 ounce platinum and 100 ounce palladium bars must be manufactured to exact weight specifications. For centuries, gold has been considered a great store of value that can both reduce the volatility of an investment portfolio and help investors in protecting the purchasing power of their money, as the value of this precious metal tends to appreciate when inflation is rising. ETFs are a paper instrument with counterparty risks, and do not allow you to take physical possession of your gold and silver. Make Gold Investment Easy with American Hartford Gold Group Start Growing Your Wealth Today. They also have to be minted by the Treasury Department. Additionally, it is essential to ensure that the provider is properly licensed and insured. Secure Your Financial Future with Lear Capital: A Trusted Name in Precious Metals Investing. Always use the customer care numbers displayed on Bank’s official website. First, choose a custodian that offers silver as an investment option for your IRA.

Side Panel Text Widget

Reviews of gold IRA companies and their services are crucial when determining who you want to work with. Once you’ve committed to a gold IRA company, the next step is setting up your precious metals IRA. Ask lots of questions about fees and make sure the company is legitimate. The company is renowned for its expertise in gold IRAs, offering clients the highest quality gold products and services. Gold and silver IRA investments are becoming increasingly popular as a way to diversify and protect one’s retirement savings. Silver demand for hundreds of uses and applications in industry and other fields helps to explain why these Silver IRAs have become second only to gold ones in popularity. The company presents an option to their customers to sell their precious metals to them first, minus the usual liquidation fees. If they don’t, they might have to pay additional fees for accidentally committing mistakes. 9% silver and issued as legal tender. AGE has many years of experience helping customers to establish and maintain secure and profitable IRA portfolios of physical precious metals. Your current plan may not give you the option to invest in gold, but there are numerous other plans that allow gold investments. Founded in: 2011Headquarters: Calabasas, CaliforniaType: PrivateEmployee Size: 51 200Services Offered: Gold and Silver IRAs, Wealth Protection, Self directed IRA, Retirement Planning, 401k rollover. Discover the Brilliance of Oxford Gold Group. The Birch Gold Group offers a wide variety of precious metals selections including gold, silver, platinum, and palladium coins and bars.

Benefits

We loved that Mark was attentive and followed through in answering our questions. Setting up a precious metals IRA need not be difficult, expensive, or time consuming. Once you’ve found a dealer, you can look at the products that are available for purchase. A custodian firm administers the account and handles all aspects from purchasing to storing the gold according to the account holder’s directions. It also uses Delaware Depository, which offers insurance of up to $1 billion. Money must retain the same look regarding its design to ensure it is recognizable, with each current identical to the next of its type and value. Box 841437Dallas, TX 75284 1437. You always have the option of chatting with your financial advisor and shifting investments around in your portfolio based on what makes sense at the time based on your personal financial goals and the economy. Birch Gold Group has a large list of available popular options for precious metals for investors. After an initial telephone consultation, we send an e mail that contains links to trust companies we use to administer the program. As a result, gold IRA investing can help you protect and diversify your retirement portfolio. They’ll have to fill out forms with their information, create an account, select the best products, and invest in them. No slabbed/graded “rare” coins are allowed, which should not be a concern because they are highly risky and tend to be poor investments. When fears of another Great Depression begin to arise, investors get frightened and restless.

4 Most Common Problems With gold and silver ira

The dollar perpetually declines in purchasing power. Working together, we can help you open and build a customized precious metals IRA, penalty free, using the funds in your existing IRA. This industry encompasses consumer photography, graphic arts, and radiography x rays, used in medicine and heavy machinery inspection. First, you need to carry out detailed research on the custodians and the types of coins and bullions in the market. Any Gold IRA stored at home could be subject to an IRS tax penalty of 10%, so it’s worth your while to store your gold or precious metal investments in an IRS approved facility. These fees vary, but may include a one time set up fee and a yearly custodial fee.

ErfahrungenScout

See the full list of IRA approved platinum coins. They offer easy to understand information on topics such as taxes, regulations, and other important aspects of investing in gold. We were in a tough bind with a traditional lender leaving us high and dry at the 11th hour but New Silver gave us options and was able to get us the clear to close in lighting speed. How to set up an IRA with Goldco. Using an IRA to invest in precious metal assets becomes especially problematic when you’re at or near retirement age. 10K investment minimum. Their features are designed to ensure safety and simplicity, making it a great option for those looking to invest in gold. One of the ways to fund your account is through a silver IRA rollover.

LEGAL SERVICES

While the majority of investors prefer investing in more traditional assets, such as bonds, stocks, and mutual funds, the tax code also allows people to invest in precious metals such as silver and gold using specialized IRA accounts. Alternatively, if you are a precious metal collector who loves to see their collection always, then going for the segregated option might be ideal. However, the coins or bullion must be held by the IRA trustee or custodian rather than by the IRA owner. With a silver IRA, you can purchase physical silver coins and bars, or you can purchase silver ETFs or mutual funds. Bullion exchanges, such as the American Bullion, provide a platform for buying and selling silver futures contracts. We’ll also go over the pros and cons of gold IRAs and common fees. You cannot, for example, keep funds in your account that have been rolled over from IRA accounts for more than 60 days. Gold is often seen as a safe investment, which is why many people choose to invest in Gold IRAs.