About GoldCore

Q: Can I switch gold IRA custodians. Silver has several industrial read the article applications, accounting for more than half of global yearly demand over the last five years. © Goldcore Ltd 2003 2023. These companies are experienced in working with clients to ensure their investments are secure and that they are making the best decisions for their financial future. Why we like Noble Gold Investments:Noble Gold goes above and beyond to make you feel secure. People can trade cryptocurrencies, buy paper assets such as stocks and bonds, or even put their money in real estate. This is why you must check out the buyback programs for each company to select the one with the best buyback rates. In addition, once a traditional IRA owner reaches age 72, annual IRA required minimum distributions RMDs must be taken. The company’s secure online platform and secure storage facilities give investors peace of mind that their investments are safe. Gold IRA companies also often provide education and professional advice on precious metals investments.

Protecting Your Precious Metals Investment: Depositories

We at USAGOLD see the checkbook IRA as a risky, problematic approach to precious metals retirement planning and a bad choice for our clientele. Birch Gold’s website contains all the details you need, such as fees, taxes, and other transaction related expenses, to determine the cost of opening a gold IRA. However, you are allowed unlimited custodian to custodian IRA transfers. Here at Endeavor Metals, we are well versed in working with clients who hold traditional, ROTH, inherited, and SEP IRAs. Under the latest PLR, the rules prohibiting direct IRA investments in gold don’t apply when the gold is held by an independent trustee. You can check a loan lender’s reputation by researching their online presence, reading customer reviews, and consulting with trusted financial advisors. To execute a buy, you simply select the gold and/or silver items you would like to acquire, and your chosen precious metals dealer will complete an Investment Direction form for you. Midland has no responsibility or involvement in selecting or evaluating any investment and does not conduct any due diligence on any investment. Silver IRAs are a great way to diversify your retirement savings and add a precious metal to your portfolio. Any IRA is legally allowed to purchase gold and precious metals. With a secure storage facility and fast delivery, Patriot Gold Club is a great choice for anyone looking to invest in a silver IRA. Invest in Gold with Confidence: Try GoldBroker Today. By creating a self directed IRA, you can take advantage of the tax benefits of a traditional IRA and control your financial future by securing your savings with hard assets: physical gold and silver coins and bars.

Advantage Gold Company Review

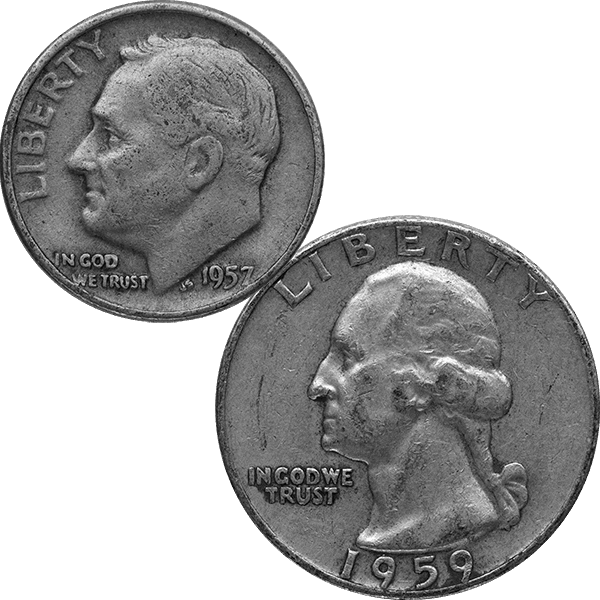

Some of the available coins are the following. Is the representative withholding information or avoiding answering your questions. In recent times, silver has experienced an unprecedented resurgence due to its high demand in global industries and manufacturing. This gold IRA rollovers guide takes into account the company’s reputation, customer service, fees, and more. There are several factors to consider when planning a distribution from your gold IRA. 202 930 5326 Gold IRA Questions. This will help determine if this is the best investment for your situation. Retirement Investments has advertising relationships with some of the offers listed on this website. WaFd Bank is a DBA Doing Business As of Washington Federal Bank. May 30, 2023 Press Release. Noble Gold is known for its excellent customer service and education. The first step in finding the right gold IRA reviews is to do some research. They must have a firm grasp of the rules, guidelines, and types of precious metals that qualify.

Never File Eviction Again: 3 Secrets to Getting Renters to Respect the Rules

Also, confirm that the custodian or broker is familiar with the IRS regulations associated with silver IRA investments. It tends hold its value. In fact, many investors who chose to add precious metals to their IRA, buy a combination of two or more of the major precious metals. However, they should only put their trust in reputable companies. Popular Silver IRA providers for 2023 include Goldco, Augusta Precious Metals, American Hartford Gold, and Noble Gold. American Hartford Gold is a Los Angeles based that was founded to help individuals and families diversify their investment portfolios by helping them invest in precious metals such as Gold, Silver, Platinum, or a combination of these metals. How long do I have to deposit my funds in my new IRA after my 401k rollover. Their team of experts are knowledgeable and experienced in helping customers navigate the complexities of investing in gold and silver. The predecessor business to Equity Trust Company was established in 1974 and the IRS approved as a custodian in 1983. Next, you’ll transfer the funds to your account. Although it’s important to keep in mind that there are many risks, in addition to tax exposure, associated with investing in precious metals.

Why Choose GMRgold as Your IRA or 401k Advisor?

Which Metals Are Best for My IRA. Silver bars and coins are similar in many ways, but there are some significant differences between them that investors should be aware of before making a purchase. Silver IRA Admission Form. This Austin based firm offers a highly secure storage facility, free phone consultations, and a wealth of free educational information. Unacceptable Precious Metals. Noble Gold is renowned for its expertise in retirement planning, offering customers a wide range of options to ensure their financial security. However, choosing the correct company to work with is crucial, so they should take some time before deciding. Best ai writing software. You’ll be happy you did. Unlock Your Financial Potential with Advantage Gold. Equity Trust Company charges a set up fee of $50 and annual maintenance fee starts at $225. Other approved metals include rhodium and certain types of coins that are minted by the U. 5000 list of America’s fastest growing private companies. The IRS has limitations on where you can store your gold and silver investments, and even on what gold coins you can buy.

Expenses and Fees: 4 9/5

You are hedging inflation by buying physical gold and are not caught up in the stock market. Everyone’s financial situation and retirement goals are different, and it’s crucial to speak to a financial advisor to see whether a gold IRA is a smart investment for your needs. The first option is In Kind where your physical precious metals will be sent to your address. Terms of Use Privacy Policy Site Map. The company provides free shipping for silver and gold purchases to its customers in the US, while also offering international shipping, primarily to France. With their gold IRA custodian services, investors can be sure that their gold investments are secure and protected. Gold is not just a beautiful shiny metal, it has real life commercial uses in various industries such as electronics, architecture, high technology, medicine, and more. Traditional IRA IRA opened by an individual. However, we are not IRA specialists.

Customer Ratings

In the last decade and a half, retirement accounts that had precious metals in them had less volatility and outperformed the Dow Jones and the S andP 500 index. However, they can’t keep them at home. For more information, please read our full disclaimer. “While we have warned consumers about these scams, we are concerned that unscrupulous companies may be using aggressive advertising through search products to lure distressed borrowers,” Chopra said. To contact Patriot Gold Group, call 844 524 9001 or get a free investor kit online. A proven safe haven for centuries, gold and silver can help protect your retirement savings from financial risk and economic downturn. For an in depth look at gold’s role in preserving assets under adverse economic circumstances, we recommend the study, Black SwansYellow Gold – How gold performs in periods of deflation, disinflation, stagflation, and hyperinflation”. Goldco specializes in IRA and 401k rollovers. They convince investors that graded coins are superior to ungraded coins. The one other significant drawback of Augusta Precious Metals is the $50,000 minimum investment required to establish a gold IRA. Some companies are easier to deal with than others, so if someone says they had a bad experience, you should not take this lightly because it might also impact your experience.

GoldCo: IRA Accounts Gold and Silver IRA

They’re gold IRA specialists with a great reputation that charges low fees and has an excellent as well as easy buyback program. You can open a new account online in less than 24 hours, and the company will assign you a dedicated account executive to walk you through the investment process. Texas protects states’ rights. You will also be required to pay an annual fee of $175 for accounts valued below $100,000. In a direct rollover, you never receive a check for your distribution; rather, your 401k plan provider will transfer the money directly into your new IRA plan. However, they do take things a bit further by making such information accessible for would be clients. Furthermore, customers can also look at a custodian’s reputation on the BBB to determine whether or not it’s trustworthy. Conversely, how weighty would it be for your pockets to walk around with enough lead, aluminum, bronze, or copper coins to pay for your new house. According to Internal Revenue Code Section 408m, a financial institution or a custodian that is approved by the IRS must physically hold precious metals IRA. In essence, Augusta Precious Metals informs you of everything you should know expense wise when setting up a gold IRA account with them. Although we have outlined only four steps, bear in mind that each is very important and requires a lot of research and preparation on your part to get right. By using the services provided by these companies, customers can ensure that their gold investments are properly managed and protected.

How to Convert Your 401k to Physical Gold

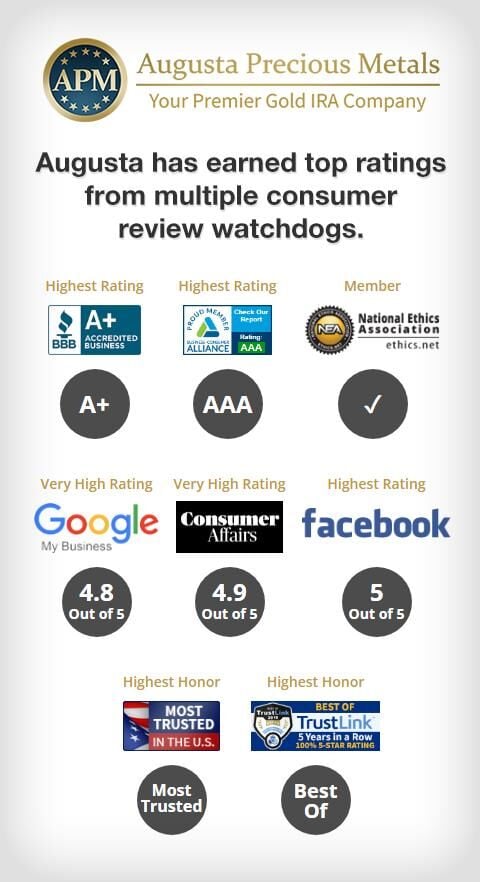

This makes gold a very attractive investment for those looking to maximize their retirement savings. The following are some of the reasons why the majority believe that Birch Gold Group is one of the best IRA gold firms in the country. Look for the firm’s owners and key personnel, then do an internet search on those names. Make sure that the company is trustworthy and familiarize yourself with any fees and expenses they charge before you open up an account. Based inMinnetonka, MN. It’s probably the most popular gold IRA company out there, and it’s due to good reason. In turn, this has caused people to review their investment portfolios to include alternative investments that provide a hedge against market and currency flatters. More specifically, with whom do you set it up. Traditionally, they made bids and offers on the price of gold. Moreover, Advantage Gold provides competitive rates and fees, making it one of the leading gold IRA companies in the sector. Preserving and protecting wealth over time is what Gold is all about. I can’t overemphasize that the best gold companies have high rankings on platforms like TrustLink and Business Consumer Alliance.

Purchase Metals from Accurate Precious Metals

According to the Wells Fargo website, “Due to current market conditions, we are temporarily suspending new applications for home equity lines of credit. Investing in a Gold IRA can be complex, and you’ll likely have questions or concerns along the way. Now technology is swinging lending in a totally new direction, stay tuned for part two of this blog where we’ll discuss what the future of lending holds. Oxford Gold Group: Your Trusted Partner for Precious Metals Investments. When choosing a silver IRA provider, it is important to research the company thoroughly. Popular bars or proof coins include American Eagle, Australian Kangaroo or Nugget, Austrian Philharmonic, Canadian Maple Leaf, Mexican Libertad, plus more. Secure Your Future with Augusta Precious Metals. Experience the Precious Difference with Augusta Precious Metals: Invest in Quality and Security Today. Not everyone can make a cash offer, so there are companies coming forward to do that on behalf of buyers. Investing in precious metals as part of diversified portfolio—along with stocks and bonds—may be a wise decision. Investors receive $1,000 in free gold if they order a minimum of $20,000.

Can I add or contribute coins or bullion that I already own to my precious metals IRA?

Silver and Palladium IRA: 5. American Eagle coins are produced by the United States Mint and contain 91. Experience the Power of Gold Alliance Today and Unlock Your Business Potential. Precious Metals and Foreign Currency. For more information, see our cookie policy. By entering your information and clicking Get Started, you consent to receive reoccurring automated marketing text messages and emails about Equity Trust’s products and services. They guarantee complete non disclosure sale transactions and purchases. These companies are experienced in working with clients to ensure their investments are secure and that they are making the best decisions for their financial future. The process of looking for buyers can be tedious and when in haste, investors may be forced to sell for a price lesser than the market price. 999 Dimensions: 117 x 53 x 15 mm Box Quantity: 15 Producer: Valcambi IRA Eligible: Yes price listed under ‘Generic’ Kilo Bar. But by requesting an info kit, you’ll get everything you need to open an account with Birch.

Trending Stories

Silver IRAs provide a number of benefits. American Bullion is worth your consideration if opening a gold IRA or interested in buying gold and silver for your personal collection. STEP 2: There are three ways to fund your new IRA 1 prior and current year contributions with a personal check or bank wire 2 custodian to custodian direct transfer if you are using funds from an existing IRA 3 IRA rollover, if you are using qualified funds from a 401k or a pension plan. Many financial experts recommend keeping 5% to 10% of a portfolio in gold. The types of gold that can be held in a gold IRA include gold bullion bars and coins, as well as certain types of gold coins. In terms of price, it will be close to the most recent market value. Nonetheless, you can contribute to an IRA and 401k, which raises the need to consider a fidelity IRA. Goldco Highest rated and most trusted. In either case, you must first contact a reputable precious metal dealer to decide which type of silver would be best for your IRA. Where are my metals stored and are they insured.

Related Info

Secure Your Future with Lear Capital’s Expertise. If you can find diversification from the usual kinds of assets, like stocks, then if anything goes wrong, you’ll have a backup that helps you keep the value of your accounts up as high as possible. Here are the answers to frequently asked questions about gold and other precious metals in an IRA. Please inquire with your IRA custodian for specific plan details or any plan limitations. American Gold Buffalo uncirculated coins. We do the heavy lifting by facilitating the transfer of funds for you. Advantage Gold is an industry leader precious metal dealing company located in Los Angles, California. Most financial experts also recommend it. No Trustworthy silver company will ever rush you to make a decision with setting up an IRA. When you open a Precious Metals IRA, all of your precious metals will be stored in a secure vault at an insured depository. After all, if anything goes wrong or the company goes defunct while you have potentially thousands of dollars in assets invested with them, you’re going to want to know the names of the team members to pursue legal action. While every real estate investor follows a different path, here’s a sample outline for how a rental investor might finance their first rental properties. When the dollar goes down, gold and silver will probably go up.

Our Philosophy

Discover the Value of Augusta Precious Metals: Invest in Quality Precious Metals Today. Additionally, these gold IRA custodians provide a variety of IRA accounts, from traditional IRAs to Roth IRAs. Once you link to another web site not maintained by GoldStar Trust, you are subject to the terms and conditions of that web site, including but not limited to its privacy policy. The CEO has experience in assisting seniors with financial planning. Silver is an important precious metal that many companies use for their products. The company will also assist you in extending traditional retirement accounts into a precious metals IRA. Invest in Quality with Oxford Gold Group. They can also provide you with access to a wide range of investment options, including bullion coins, bars, and exchange traded funds ETFs. Precious metals, Gold American Eagles, Proof Gold American Eagles, certified gold coins, as well as gold and silver bars carry risk and investing in precious metals directly or through an IRA is not suitable for all investors. We recommend working with dealers who know and understand the purchase of precious metals with retirement funds. A compliant and reputable precious metals IRA company will ensure that all rollover and transfer processes are properly facilitated and that the resulting self directed precious metals IRA continues to comply with governing regulations. Birch Gold has built its reputation on customer service as is clear if you read the online testimonials.

Pros

You’ll also want to make sure that your portfolio remains balanced by occasionally selling off some of what you’ve purchased throughout the year if prices go up too far beyond where they were when you bought them originally. If you are planning on rolling over an existing IRA to a new one you will be assigned a Precious Metals IRA custodian. They may also mention the types of gold and other precious metals that are available for purchase and the storage options offered. The answer is passive income. Education first user experience. We loved that Mark was attentive and followed through in answering our questions. Scott is an attorney and a graduate of the University of Florida Law School.

Loan Amounts

The median salary for college graduates is higher than it is for those with only a high school diploma, but this isn’t necessarily true for every occupation. Additionally be aware that precious metals carry risk of loss and are not a suitable investment for everyone. With an indirect rollover, your existing 401k provider sends you a check for the proceeds that you deposit into your personal bank account. As a tangible investment, gold offers investors security in turbulent markets. Gold and silver special reports. Your retirement savings may be safe in a silver IRA. That being said, performing due diligence, when and how you buy your precious metals, is up to you as the IRA owner. While traditional IRAs typically consist of stocks, bonds, and mutual funds, some investors seek to diversify their portfolios by including precious metals. Gold bullion refers to bars or ingots that have both the purity and weight stamped on the bar. The process is quick and easy. Their website contains all the required information, such as fees, charges, and transaction related expenses. You can hire a car, real estate or art appraiser to view the current condition of your assets so you have an accurate number to report on your loan application.

好评论

American Hartford Gold Kit 2023: Get here. Their Royal Survival Packs offer a convenient solution for those who don’t have the time to do research, as the high quality gold coins come pre selected. Advantage Gold’s commitment to customer satisfaction and secure silver IRA investments make it a top choice for those looking to diversify their portfolios. The company was named in the Inc. This event went off flawlessly so this year I sold a lot of my stock and again invested it into Precious Metals with Goldco. Secure Your Retirement Now. In March 2008, Bear Stearns went out of business. Fine content is measured in Troy ounces. To contact Patriot Gold Group, call 844 524 9001 or get a free investor kit online. 5000’s 2021 list of America’s fastest growing private companies, you can be sure that you’re in good hands with American Hartford Gold Group. On one hand, they help you diversify your investment portfolio, are safe, and provide account holders with a level of control that other retirement solutions simply do not offer. Browse platforms and providers in private equity, cryptocurrency, lending, real estate, and precious metals asset classes – all in one place.

Anna Miller

When comparing the top four brands, GoldCo offers a unique mix of high quality customer service and competitive pricing. Here are some of the general benefits of investing in a gold and silver IRA. Discover the Benefits of GoldBroker: Invest in Gold with Confidence. Secure Your Retirement With Birch Gold Group. The second funding option involves rolling over your investments from certain qualified retirement plans such as Traditional and Roth IRA, 403b, 401k, and Thrift Savings Plan TSPs. What Are the IRS approved Coins Can You Hold in a Gold IRA. Like a lot of excellent precious metals IRA companies out there, Birch Gold assures full transparency over their fees. Secure Your Retirement with GoldCo. Investing with Patriot Gold Group is fast, easy, and affordable. Morgan Asset Management. Most precious metals IRA custodians, however, offer insurance to safeguard your investment. Just as with any other investment, updates on the status of your investment and earnings will be available to you at any time. How Do Gold IRAs Work. Precious metals may be good at retaining and appreciating value but are terrible at generating income.